1 Day Only 20% Off Sale!

Saturday, November 28

|

|

|

| Normally $18.95 – Now $15.16 | Normally $16.95 – Now $13.56 | |

|

|

|

More About Thrive in Five

Each year do you resolve to improve your finances only to have something happen that pushes you back to the same place you were last year? Thrive In Five: Take Charge of Your Finances in 5 Minutes a Day will help you change that. With daily short tips that take five minutes or less, this book will help you improve your credit score, spend less, and save more money – all while getting organized!

“Thrive In Five: Take Charge of Your Finances In Five Minutes A Day” is a comprehensive, no nonsense book.

Jill’s direct, easy-to-understand style makes it Super Easy to take control of your finances TODAY. As someone who’s worked in a financial institution for 15 years, I’ve never seen everything so comprehensively laid out. This book should be required reading, and can be given to anyone at any age to help them save money. Jill truly understands that finances don’t have to be dull, boring and complicated. She even gives you days to ‘catch up’!

It sends chills up my spine to think about all of the people who don’t know these simple, doable steps.

READ this book and quickly take control of your finances. And get this— Each day the steps are written in a day-by-day, paint-by-numbers format, all EASY yet DOABLE!

Hey, it only takes five minutes or so each day — yet each step can take you one step closer to finally taking control of your finances!

I say get this book and get this book right NOW! It’s awesome!”

– Tracey Fieber, Retirement Transition Expert

New Face of Retirement

www.NewFaceofRetirement.com

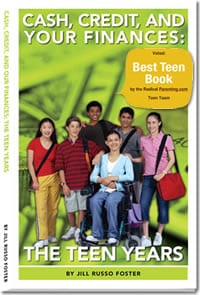

More about Cash, Credit and Your Finances

The Perfect Teen Gift

Help your kids:

- Cope with product advertising

- Understand that credit isn’t magic money.

- Develop strong short-term budgeting skills

- Create a long-term financial plan

Cash, Credit, and Your Finances: The Teen Years looks at finances through the eyes of five different teenagers. They all have things they want and need, but they all handle their money differently. Some will succeed and some will give up… which one do you want your child to be?

Leave a Reply