Let’s talk about paying for tuition. Last issue we discussed financial aid – specifically, the importance of submitting your FAFSA application as soon as possible. While it’s nice to get financial aid, many students don’t qualify. I am one of them. So what can you do?

Apply for a Scholarhip

Many scholarships require a FAFSA application, so get moving on it.

What scholarships should you apply for? Look for ones that meet your skills, interests or living status. For example:

- Extra-curricular achievements like sports, music, theater, or technical competitions. If you have a talent, there may be a scholarship for you. Schools stay competitive partly through their extra-curricular programs, so they’re willing to pay. Look beyond the school as well, because there may be an outside group interested in advancing your particular skill set.

- Potential major or field of study. These scholarships are created to draw interest or excellence to a particular field. It may be initiated by the school, a group of professionals, or a single wealthy donor. If you know what you want to study, look for a matching scholarship.

- Your living status. Often initiated by a person or a group who has “been there,” knows that’s where you are, and wants you to succeed regardless. It could be for students who come from a particular town, a particular ancestry or ethnic group, whose parents are veterans of foreign wars, who have a particular medical condition, or who are single parents. It could be anything, really. Who knows how many scholarships like this are out there?

Read over the requirements carefully to make sure you meet them. Don’t waste your time, or theirs, by applying for a scholarship you won’t get because you aren’t Polish American or haven’t studied dance.

Be prepared to write essays, get references and provide any proofs required. This will take time and effort, but if you receive a scholarship – Yay! You got free money!

Student Loans – The Last Resort

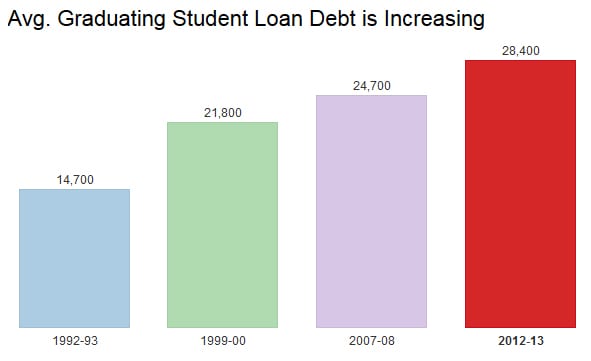

According to US News and World Report, 69% of graduating students in 2013 had an average of $28,400 in student loan debt. Depending on the college (state or private), the actual range was between $2,500 and $71,000. This is a huge amount of debt to start your career with.

How to choose a loan:

- Always start with subsidized loans versus unsubsidized student loans, and take government loans before private. Student loans are always changing, so do your research for the most up-to-date rates and conditions.

- Use a student loan calculator to determine your future payments (US Department of Education Online Repayment Estimator).

Understand your student loans before you sign to protect your future financial well-being.

Leave a Reply