What destinations are on your travel bucket list?

If money and time weren’t an issue, where you you travel to?

Spring Cleaning Your Finances

Spring is a great time of year! One of my favorites, as the weather turns warmer and the days are longer. For us, it means more time outside and that can be from getting my garden planted and the thrill of fresh vegetables right in my backyard, to having meals outside; either just us or with friends and family. We can open the windows to air out the winter stale indoor air and sleep comfortably with the windows open all night. It means exploring the outdoors, maybe taking a walk in a new neighborhood or park, picnics and movies in the park.

With spring comes weddings and graduations – new beginnings. This can be true for all of us, even if we don’t have a milestone event coming up.

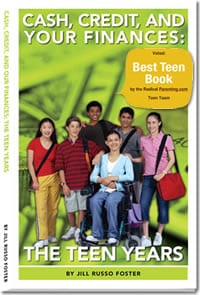

Traditionally, spring makes me think of spring cleaning and tackling the heavier cleaning throughout the house. We can do the same for our finances. For the graduate, you can start them off with the gift of good finances – being able to start to plan their money and finance proactively and make planned purchases versus impulse buying. A great way to start would be the gift of my book, Cash Credit and Your Finances: The Teen Years.

For those who want to get your own finances back on track, 111 Ways to Save or Thrive In Five: Take Charge of Your Finances in 5 Minutes a Day will give you the push you need to get your finances in order.

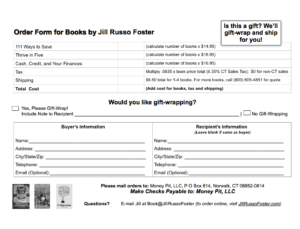

You can order my books through my website or by order form. If you use the order form, you have the option of me personalizing the book. Just print the order form, fill out the recipient information section, and mail it to the address on the form or fax it to 203-504-7995. For the month of June 2017, we are also offering free shipping on all book sales that are ordered with the order form via mail or fax.

Click here to download the order form.

Save

Got vacation plans coming up?

We always recheck the pricing on hotels, cruises, rental cars and more. Just last week, we found our hotel room was $60 less per night. Made a new reservation and cancelled the original. Make sure to check your reservations to save more money.

New uses for things to travel with

I always use travel pill cases when I travel – but not for pills. This time I used it to take my earrings, necklaces and other jewelry. All stays organized and it’s easy to carry or pack. For more tips, follow my blog at www.JillRussoFoster.com.

Saving money with our garden

The first strawberries of the season! Organic, home-grown strawberries ready for the picking. All you pay for is the cost of the plants. These come back each year. Remember to use netting so the birds don’t get them first.

Is your recent grad looking for their first job?

This is a great article about recent grads and tips for getting their first time job. Read more

Graduation is nearing …

Do you want your teen to start off their money and finances is a good way? Teach them to make choices that are right for them and come from a place of understanding. Give them the gift of Cash, Credit and Your Finances: The Teen Years. It’s simple to order at JillRussoFoster.com. If you want them book personalized to them, use this order form to order from us directly.

If you love to travel like us, you may want to read this

Planning a beach vacation

We love the beach. When we travel to a beach / pool destination, we bring along our own toys – noodles, rafts, snorkel gear and more. Not only does this save us money (much cheaper than buying at a hotel or destination), we always have what we want when we want it. This works because we have free checked luggage with our airline credit card. For more money saving tips visit www.JillRussoFoster.com and subscribe to our blog.

- « Previous Page

- 1

- …

- 37

- 38

- 39

- 40

- 41

- …

- 80

- Next Page »