Valentine’s Day doesn’t have to cost a fortune with an expensive dinners, gifts and flowers. There are alternatives to celebrate and have fun too.

Clarke Howard shares this article on  . 14 Ways To Save on Valentine’s Day

. 14 Ways To Save on Valentine’s Day

Tips for Successful Personal Finances

Valentine’s Day doesn’t have to cost a fortune with an expensive dinners, gifts and flowers. There are alternatives to celebrate and have fun too.

Clarke Howard shares this article on  . 14 Ways To Save on Valentine’s Day

. 14 Ways To Save on Valentine’s Day

Yes, it’s that time of year again – tax time! YOu can begin filing your tax returns today. If money is tight, you may be hoping for a refund. But, like many people, you probably have to use part of your refund to pay for having your taxes done.

But, what if you didn’t have to pay a tax preparer? If you have a simple tax return, and you earned less than there limits, you can qualify for FREE tax preparation. The IRS has free filings for income under $66,000, while VITA (more on VITA below) limit is $54,000. Or, check out AARP Foundation Tax-Aide, which has different guidelines by state.

These are the three safest and most reliable options for no-cost income tax preparation (that I know of.)

I know there are some other companies that promise free preparation, but watch for these restrictions:

With the IRS, VITA and AARP, you don’t have to rush and they do both Federal and State (if local rules allow).

Find out if you qualify for VITA (Volunteer Income Tax Assistance)

Volunteer Income Tax Assistance (VITA) has volunteers trained by the IRS to do tax preparation for people who are low to moderate income (families earning less than $50,000.) There are locations in every state, typically at public buildings (like libraries, schools, or town government offices). All have different days and hours. Find the location that meets your schedule by visiting the IRS website.

Find out if you qualify for AARP Foundation Tax-Aide

AARP also offers tax preparation services under their program AARP Foundation Tax-Aide. The program gives special attention to those over 60 years of age. There are eligibility requirements that must be met to take advantage of this service. For more information go to AARP.org

These programs are both designed for those with relatively simple tax returns. People who have more complicated returns that include rental property, buying and selling of investments, or businesses are usually not eligible. Check with each organization for locations and eligibility requirements.

Remember: this year April 15 falls on a Monday and that may be a Federal holiday depending on where you live, so you may have an extra days to file your taxes!

If you are like me you love to save. Getting something for less makes my day. So imagine if you could save even more. Well I have done great this holiday time.

If you are like me you love to save. Getting something for less makes my day. So imagine if you could save even more. Well I have done great this holiday time.

I have shopped online and in person and saved both ways. Just yesterday, I found the item I have been looking for with double the savings. I have been looking for a great multi purpose day tote / carry on. It has to do double duty to carry all my items as a carry on (needs to be sturdy and have pockets) and it has to double as a day tote for shore excursions (to handle all that’s needed on shore) and zip closed. I have been searching and looking for months – at the outlets, at the famous tent sale last week and found it online this weekend.

I tell you this because I wanted this and I wanted it at a bargain. First, it was on sale for 40% off, then the site offered free shipping and easy returns – a must. Then I found an additional discount with Honey to make the saving even greater.

Another example, I purchased windshield wiper blades with a discount coupon at the auto parts store. They installed them for free which is also great. I came home a found a rebate offer on the purchase of two blades and immediately completed the online rebate. I do this online so that I can keep track of the rebate status.

Yes, I do this with most of my shopping year round. Double and sometimes triple savings with coupons, cash back /rebate offers and credit card rewards all add up to savings. How are you saving with your shopping this holiday season?

This year we celebrated our anniversary with a Pacific Northwest cruise.

Back in the early summer, I wrote two newsletters about planning our fall vacation. We are back and wanted to share the trip with you. Here’s the link to the two earlier newsletters – first and second issues to remind you of the details.

We took a Pacific Northwest cruise out of Seattle with stops at Astoria, Oregon, San Francisco, California and Victoria, BC and few days in Seattle too.

With all this planning and paying ahead, we spent very little on the actual vacation. Mostly everything was paid (or paid with points / miles) in the months before as our budget permitted – hotel, cruise, airfare, attractions and some meals were included. We selected hotels with breakfast included, bought City Pass’ (discount admission to attractions) and walked and/or public transportation. Lots of steps – over 21,000 in San Francisco in one day!

Yes, there was a lot of research and planning, but this step saved us money and we have fun – lots of money!

Here we are at the Space Needle. To view more photos, visit our Pinterest page.

Have you wanted to get outdoors and explore a new area? Here is the northeast, it would be wonderful to see spring  temperatures to that. Well April 21 to 29 is National Parks Week and admission to some National Parks is waived on the first day – April 21.

temperatures to that. Well April 21 to 29 is National Parks Week and admission to some National Parks is waived on the first day – April 21.

Want to know which parks are in your neighborhood and if they are participating? For more details visit the website.

This is a great way to get out and explore, exercise and just have fun!

Can’t make it on April 21, check out the as they are other days of the year that are free.

This is a great memory from my childhood. I loved going with my mom to the library and taking out a book. In fact, I still use the local library and read many books each year.

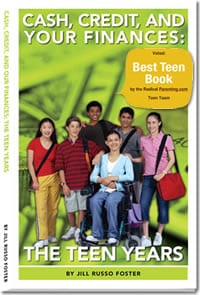

In honor of Take Your Child To The Library Day which is February 3, 2018, I am offering you a 20% discount on my book Cash, Credit and Your Finances: The Teen Years from now until February 3. For $20.00 you can purchase a copy of my book directly from me, have it personalized to your recipient and it including priority shipping. This is only available from my website. Click here to purchase.

Voted “Best Teen Book” by Radical Parenting Teen Team

Cash, Credit, and Your Finances: The Teen Years looks at finances through the eyes of five different teenagers. They all have things they want and need, but they all handle their money differently. Some will succeed and some will give up… which one do you want your child to be?

Start your child off with the gift of reading and learning great money skills. Buy Cash, Credit and Your Finances: The Teen Years now!

![]()

I love getting a discount. Don’t you?

When we grocery shop, we use coupons, meal plan and shop the sales. We eat healthy with any organic products, so there aren’t as many coupons as in the past. Yes, items do go on sale, but it can still be expensive.

Our grocery store gives us gas points. For every dollar we spend, we get points – 100 points is 10¢ off per gallon. Last weekend we saved 90¢ per gallon. That certainly helps our budget and can helpful to you.

Are you getting all the rewards possible? Learn more on discounts and rewards.

It’s summer and the kids are home from school, what do you do? Here are some tips to keep them entertained.

Here are some tips that we personally have done in our community for low or no cost. Let me know what you are planning.

My answer is always, yes!!!

We have traveled to lots of places and not spent too much. It does take planning, but we find it well worth it.

You need to search for great deals on the places you want to explore. Look for sales, perks and discounts. Research your options. Right now we are researching an upcoming trip. We are looking for a hotel that is centrally located and near transportation hubs.

Last year in Italy, we stayed at a hotel by the airport. We were able to walk to the hotel when we arrived. You might be thinking it’s not convenient. This particular hotel had a fee shuttle to downtown Rome every two hour between 8 am and 11pm. Yeah! No transportation costs.

For places to stay, we look for hotels / timeshares that have kitchen facilities. It’s more cost effective to go to the market and purchase food than to eat our for every meal. Plus, if possible, you can bring things from home. No, you cannot bring meat and vegetables. You can bring items that you only need a few of instead of buying a large quantity (think salt, pepper, steel wool, paper goods and more). This is a photo from a beach vacation and what we packed in our luggage.

What do you do to reduce your travel costs?