Today, I am doing a workshop, Money Make The World go Round at Empower Her for kids ages 8 to 11. We are going to discuss budgeting, wants, needs with the help of a fun game!

Need some encouragement to live within your means

Spring Cleaning Your Finances

Spring is a great time of year! One of my favorites, as the weather turns warmer and the days are longer. For us, it means more time outside and that can be from getting my garden planted and the thrill of fresh vegetables right in my backyard, to having meals outside; either just us or with friends and family. We can open the windows to air out the winter stale indoor air and sleep comfortably with the windows open all night. It means exploring the outdoors, maybe taking a walk in a new neighborhood or park, picnics and movies in the park.

With spring comes weddings and graduations – new beginnings. This can be true for all of us, even if we don’t have a milestone event coming up.

Traditionally, spring makes me think of spring cleaning and tackling the heavier cleaning throughout the house. We can do the same for our finances. For the graduate, you can start them off with the gift of good finances – being able to start to plan their money and finance proactively and make planned purchases versus impulse buying. A great way to start would be the gift of my book, Cash Credit and Your Finances: The Teen Years.

For those who want to get your own finances back on track, 111 Ways to Save or Thrive In Five: Take Charge of Your Finances in 5 Minutes a Day will give you the push you need to get your finances in order.

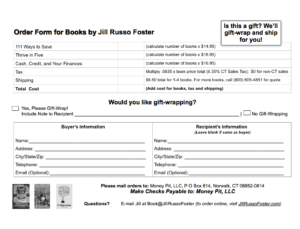

You can order my books through my website or by order form. If you use the order form, you have the option of me personalizing the book. Just print the order form, fill out the recipient information section, and mail it to the address on the form or fax it to 203-504-7995. For the month of June 2017, we are also offering free shipping on all book sales that are ordered with the order form via mail or fax.

Click here to download the order form.

Save

More Money Tips

I always read these articles to make more changes to our finances

http://www.redbookmag.com/life/money-career/g4285/best-money-advice/

Should teens pay some of the cost of driving?

What do you think?

Are you paying too much for TV?

Are they talking about your finances?

Don’t be in credit card debt. Make a plan to pay it off.

https://wallethub.com/edu/credit-card-debt-study/24400/

Time to spring clean your finances

Finances need a clean up, why not do this now for spring

What’s More Important-Less Debt or an Emergency Fund?

The age-old question of payoff debt versus an emergency fund – which is more important?

If you have debt, then you know that the interest you are paying is a drain on your finances. You are correct, that interest is a waste of your hard-earned money. You know that you need an emergency fund and you have been meaning to start one, but you just don’t have the money.

Which should you tackle first? Let’s assume you have $500 in your budget to work with and we will look at a couple of scenarios.

#1 – You have debt totaling $10,000 and you are paying the minimum payment of $250 per month at an interest rate of 20%. It will take you 67 months (5+ years) and you will have paid back $16,750 ($6,750 in interest). That’s assuming you don’t take on more debt.

Then you put the remaining $250 to start your emergency fund.

#2 – You increase your payment on your debt to $500 per month. It will take you 25 months (just over 2 years) and you will have paid back $12,500.

You will not be starting your emergency fund until after the debt is paid. What would you do if an emergency expense happened? How would you pay for it?

As you can see, the answer is somewhere in the middle and you can think outside the box for faster results. You could look into reducing the interest rate on your debt – refinancing, balance transfer for a lower interest rate etc. The quicker you payoff the balance, the less you will pay in interest.

You need an emergency fund to be prepared for whatever happens in life. You will want to start to save something on a regular basis each and every month, even if you have debt.

Save

I Challenge You to Track Your Expenses

Have you ever written down a budget to see where your money is going? Well, we did this earlier this month and everything looks fine, meaning that we make more than we spend.

That means we can pay our bills – great! That’s check one. Check two – are we saving enough? No, we we’re not, but where do we get the money? We won’t find extra money to save until we find out exactly where our money is going.

If you want to do this process with me, follow these steps:

1. Write down a couple of short and long term goals, so you’ll be inspired to do the work.

Short term goals can be planning for a vacation, buying a car, paying down debt, saving for something that you want, and starting an emergency fund.

Long term goals can be saving to purchase a home, saving for your children’s education, retirement planning, and paying off debt/mortgage. What are yours? Imagine what you want or need and write it down now.

2. Track every penny you spend. That means finding a way to record your spending as it happens.

Don’t wait until the end of the month and use your bank statement or receipts. A single store can fall under many spending categories and receipts don’t always list items by name (or by names that you can decipher). Don’t think for a minute that your grocery store trip can be lumped under food. You may buy your pet food there, as well as cleaning supplies, shampoo, or even magazines.

I know this sounds time consuming, but it’s worth it. You can carry a pen and pad with you and write down everything by hand. Another way to track your money is by using a phone app. Choose the way that works best for your lifestyle.

3. Write your totals in a budget worksheet to see where you stand.

Once you see a month’s worth of numbers, than you can begin to analyze what is going on. With this clear picture, you can make changes – lower bills to save money, get rid of unused services, check out the competition to switch etc.

Tell me what you have discovered with this exercise. Next issue, I will tell you what we have changed.

Save

Save

Save

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 7

- Next Page »