Learn how these people overcame their debt.

What have you done to paydown your debt?

Tips for Successful Personal Finances

Learn how these people overcame their debt.

What have you done to paydown your debt?

Summer is coming and that makes me think of vacations. You might be saying, here they go again! You may be right, but not yet. There are a couple planned for later this year.

• Noodles / Rafts / Tubes / Snorkel Gear

• Soft-sided cooler – we have one that the freeze pack is a part of the cooler

(one less thing to carry along)

• Entertainment – playing cards, games, etc.

When we travel to a destination, we try to reserve a unit with a kitchen or at least a fridge. This saves us so much money by being able to make and bring our own meals. You might be thinking cooking on vacation – ugh! This can be as simple as having breakfast, beverages and snacks from a grocery store versus paying restaurant or resort prices. Picking up a bottle of water at the store is much more cost effective than buying a bottle at pool side.

Here’s an example of what we do. We bring as much as possible, especially things you won’t finish, like steel wool, paper plates, herbs and more. Next, we place an online order (if that is possible) from the grocery store before we leave. Then we either pick up the order at the store or have it delivered to where we are staying. Having some or most of your meals at grocery store prices saves money. Yes, we still do go out for some meals – just not all.

Remember that you typically cannot bring meat, fruit or vegetables out of the US and into another country. Usually, you can bring sealed items in their original packaging. Here’s one of our suitcases.

If you want a copy of my food packing list, email jill@jillrussofoster.com and I will share it with you.

We saved $1.50 per gallon with our grocery store’s gas rewards program. Didn’t buy anything special, just our usual groceries. Paid $105.9 / gallon!

We saved $1.50 per gallon with our grocery store’s gas rewards program. Didn’t buy anything special, just our usual groceries. Paid $105.9 / gallon!

We personally view our bank and credit cards accounts weekly – we check for unrecognized transactions. We use two step authentication. We don’t do this from our phones, only home computers. You may think we are overly cautious, but here’s what CNBC has so say.

We save money with our own organic garden in the yard. We grow tomatoes, lettuce, cucumbers, squash, spinach, kale, broccoli, peppers, peas, string beans and more. This saves us money each and every week as we buy less at the store.

We have been dealing with this at our home. We have inherited our parents stuff. We cleaned out the stuff, but now we are on a mission to clean out the personal items – family photos, slides & movies, stuff that may be worth money. Do we really need all this stuff?

Spring is a great time of year! One of my favorites, as the weather turns warmer and the days are longer. For us, it means more time outside and that can be from getting my garden planted and the thrill of fresh vegetables right in my backyard, to having meals outside; either just us or with friends and family. We can open the windows to air out the winter stale indoor air and sleep comfortably with the windows open all night. It means exploring the outdoors, maybe taking a walk in a new neighborhood or park, picnics and movies in the park.

With spring comes weddings and graduations – new beginnings. This can be true for all of us, even if we don’t have a milestone event coming up.

Traditionally, spring makes me think of spring cleaning and tackling the heavier cleaning throughout the house. We can do the same for our finances. For the graduate, you can start them off with the gift of good finances – being able to start to plan their money and finance proactively and make planned purchases versus impulse buying. A great way to start would be the gift of my book, Cash Credit and Your Finances: The Teen Years.

For those who want to get your own finances back on track, 111 Ways to Save or Thrive In Five: Take Charge of Your Finances in 5 Minutes a Day will give you the push you need to get your finances in order.

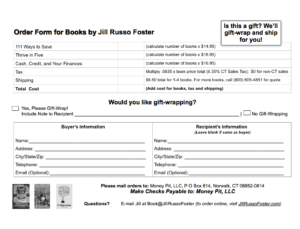

You can order my books through my website or by order form. If you use the order form, you have the option of me personalizing the book. Just print the order form, fill out the recipient information section, and mail it to the address on the form or fax it to 203-504-7995. For the month of June 2017, we are also offering free shipping on all book sales that are ordered with the order form via mail or fax.

Click here to download the order form.

Save

The first strawberries of the season! Organic, home-grown strawberries ready for the picking. All you pay for is the cost of the plants. These come back each year. Remember to use netting so the birds don’t get them first.

This is a great article about recent grads and tips for getting their first time job. Read more