Don’t be in credit card debt. Make a plan to pay it off.

https://wallethub.com/edu/credit-card-debt-study/24400/

Tips for Successful Personal Finances

Don’t be in credit card debt. Make a plan to pay it off.

https://wallethub.com/edu/credit-card-debt-study/24400/

This newsletter, we are going to talk about spending too much! Personally, we upgraded the master bedroom and bath. In addition to the insurance deductible, we added on the additional expense of better bathroom fixtures – granite counter, higher end faucet, natural stone ceramic tile and more. Yes, we did spend more (maybe too much). With a new year beginning, we need to reign in our expenses and rebuild our savings.

If your 2017 goal is to track your expenses and come up with your actual budget, there is an exercise I like my clients to do when they have their budget created. Take out two different color highlighters. Use one color for your fixed expenses (amounts that can’t easily change) and then use the second color for expenses that you can adjust or eliminate. Typically, I see three areas for the adjust or eliminate category:

Now make a list of five ways to reduce or eliminate specific items. For example, I could find a teen to shovel my snow versus paying a snow plowing service.I could download a movie for free (Hoopla) or borrow from the library versus renting and not returning on time and incurring a late fee. I could balance my checkbook regularly to know how much money I have available and not incur an overdraft fee. These are just a couple of ideas. Now make your list and track your savings. How much did you save this month? How much would that be in one year?

Are you getting the hang of it? Are there more ways to reduce or save on your expenses? Share what expenses you have reduced or eliminated by 5pm EST on March 10, 2017 as a comment below and you could win a copy of my new book 111 Ways To Save. Three winners will be selected randomly at the end of March.

Save

Save

Save

Save

Welcome to 2017. My goal for you is to keep you informed and assist you with your personal finances. Remember, that no one cares (or should care) about your finances as much as you should. This may be shocking to some, but it shouldn’t be. You have your best interests at heart.

Welcome to 2017. My goal for you is to keep you informed and assist you with your personal finances. Remember, that no one cares (or should care) about your finances as much as you should. This may be shocking to some, but it shouldn’t be. You have your best interests at heart.

From time to time I meet people who say that someone else handles the finances and they are uninformed. That’s not good enough. Every single person should know and understand their own finances individually and as a couple. So make this year the year that you make your personal finances your goal.

To get from where you are today to being in the know, step one is to make your finances a priority in your life. With that said, I don’t what to overwhelm you. Let’s start with a few easy questions, although the answers may be tough:

$ What do I earn? Sounds simple, but do you know the answer?

$ What do I own? These are your assets – your home, car, etc.

$ What do I owe? That’s a hard question for some to actually face.

I am going to give you a hint about the answers.

The first two questions should be upward moving numbers. What you earn now should be more than 10 years ago. The same with what you own. The last question should be downward moving number, unless you recently took on a mortgage.

These three simple but complex questions, are the start to being informed about your own finances.

Take some time to answer these questions and you will be more informed about your finances.

Stay tuned for more articles to get you aware of your finances.

Save

Save

While I was at Columbia College during my Financial Literacy training, I had the opportunity to meet and speak with Harold Pollack, the author of the book, The Index Card. I have always liked simplification and ways to do things easier and more efficiently, and this is a great example of this.

Finances don’t have to be rocket science, you can make your finances simple and create your own rules. He is someone, like me, who learned to make better choices with his finances. It’s never too late to start and take that first step towards your goals. He has 10 steps that he wrote on an index card that he uses to manage his finances.

So after reading his book, we made our own list for where we are right now with our finances at this stage in life. We thought about these key areas:

$ Savings – emergency, retirement, goal savings, etc. – set a goal.

$ Debt – face your debt and make a plan to payoff.

$ Insurance – make sure you have the coverage you need.

$ Investments – contributions and money management – really understand what you are doing. Don’t do this blindly.

$ Tax Advantage Savings – understand what is available and take advantage of it.

Now create your index card and post it somewhere you can see it all the time. Finances don’t have to be complicated. Start your journey today.

Save

Save

Save

Save

Save

Save

Save

Save

We’ve all heard the word “refinance”, but what typically comes to mind is mortgages. Yes, you are correct. It also can apply to other areas of your finances such as car loans, student loans and credit cards.

As with any borrowing, you want to pay off the debt as quickly as possible. But sometime you cannot afford to purchase a car with cash, so you take a car loan. You may want to look into refinancing your car loan if you can get better terms – lower interest rate.

For student loans lower interest rate is probably not the answer. You may have several loans and several payments. It might be easier for you to keep track of and have only one payment per month, if you consolidate. Check out your options to determine if this is right for you.

Credit cards are a good example. You may be payoff debt and it may seem like it takes forever. It could if you have high interest rates. Refinancing a credit card balance to a lower or zero percent interest rate will help you pay back what you owe quicker and pay less in finance charges.

As with any financial transaction, do your research and compare all terms and conditions to see if this is the right move for you and your finances at this point in your life.

With bankruptcies up, Women’s Business Development Council offers help

By Alexander Soule

Published 1:00 am, Sunday, April 19, 2015

StamfordAdvocate.com

Maclyne Josselin might catch the eye of any corporate comptroller looking to build a staff, keeping a ledger within arm’s reach in which she tracks income and expenses to the penny.

Maclyne Josselin might catch the eye of any corporate comptroller looking to build a staff, keeping a ledger within arm’s reach in which she tracks income and expenses to the penny.

Josselin’s business these days is managing her own personal finances — and “profits” have been exceeding “losses,” a welcome change from just a few years ago.

Despite an improving jobs market, and slightly higher wages and savings in Fairfield County in the past year, not to mention low oil prices and a surging stock market in the macroeconomy, personal bankruptcies rose 5.8 percent in the region last year to just over 1,500.

The local increase comes in the context of a 12.2 percent drop nationally in people seeking protection from creditors, and underscores a fragile economic recovery that is still causing pain for many, amid slow wage growth and high costs of living in Fairfield County.

While financial crises can strike from any number of directions beyond one’s control –job loss, health problems and family demands, to name a few — Josselin said she edged toward the financial cliff by living paycheck to paycheck on a nonprofit employee’s salary without eyeballing what she was spending, and was unable to save anything.

Josselin, a Stamford resident, said she was able to make the conscious decision to reverse her course, but it was difficult.

“It’s like breathing,” Josselin said, describing the habit she has honed of tracking her expenses daily. “Just getting started was the hardest part.”

With nothing to lose, Josselin began attending a free clinic on personal finance that the Women’s Business Development Council offers at its headquarters in Stamford, as well as at satellite offices in Danbury, Shelton and Hartford.

Jill Russo Foster runs WBDC’s personal financial education and budget coaching programs, and has written multiple books on personal finance, including “Thrive In Five: Take Charge of Your Finances In Five Minutes A Day.” She became an expert on the topic the hard way, saying she accumulated 27 credit cards while in her 20s before the inevitable financial disaster hit, requiring a couple of years to work to fix her credit problems.

Josselin would eventually hammer out a plan that worked to control her spending by tracking every penny — literally — that she pays out. She keeps it all in a binder she has titled “Young, Fabulous and Saving,” deriving it from the Suze Orman book “The Money Set for the Young, Fabulous & Broke.”

From student to tutor

Today, Josselin is one of WBDC’s volunteer budget coaches, having tutored three people to date in a half-dozen, one-on-one sessions spanning three months. It was intimidating at first, she said, with her first client a woman many years her senior.

Foster said about half of the people who go through the program have income putting them below the official federal poverty. Of the remaining half, she said she has counseled spouses with combined income as high as $190,000, who have fallen on hard times due to health issues, divorce or other calamitous life events.

WBDC’s advanced budget coaching sessions for people in financial crisis entail four major tenets. Perhaps surprisingly, the easiest is reducing debt, while the hardest is improving one’s credit score, mainly due to the fact it is hard to move that needle in the six-week span of the program. The other two legs of the stool are increasing one’s income-to-expenses ratio and boosting savings.

Of those who register for WBDC’s budget coaching programs, 85 percent say they have changed their spending habits. Though Foster would like to close that 15 percent gap to zero, it nevertheless is making a difference. With a staff of 16 people, five part-timers and volunteers, WBDC helps as many people as it can.

Since 2005, when Connecticut experienced a surge of bankruptcy filings before Congress stiffened rules on who could qualify, statewide bankruptcies have stayed in rough lockstep with the economy. From just under 4,000 filings in 2006 –likely an abnormally low number due to people filing in advance of the new rules — personal bankruptcies marched steadily upward to peak at nearly 11,250 cases in 2010, before receding each year to 6,750 cases last year.

Behind most of those cases there is an individual or family who has hit rock bottom, unable to make ends meet whether due to a lost job, medical bills, poor planning or bad luck.

Foster said there are common traps many people fall into, including deciding to postpone payment of a bill coming due in order to be accumulate funds to pay it off in full. Better to pay some of it right away and the rest when one is able, she said.

A utopian world

Hand in hand with bankruptcy is home foreclosure, with Corelogic tracking nearly 5,240 foreclosure proceedings in Connecticut for the 12-month period through February.

Both bankruptcy and foreclosure data can be influenced by external factors, according to Mark Stern, a Fairfield attorney who chairs the Bankruptcy Law Committee of the Fairfield County Bar Association. Those factors can include changes in bank policies regarding foreclosures or judicial retirements resulting in a backlog of cases.

Stamford state Superior Court Judge Douglas Mintz told Connecticut legislators in February that in 2012 and 2013 an increasing number of people participated in a foreclosure mediation program mandated in 2008 by the state. He said the program has helped 15,000 Connecticut families stay in their homes — 69 percent of whom signed up for mediation — and requested that the state make the program permanent.

“It would be a wonderful, utopian world where, you know, I would not have to do a foreclosure docket on a Monday morning,” Mintz said. “Even in the good times, people get sick and lose their job.”

WBDC CEO Fran Pastore said her organization had initially intended to end the budget coaching sessions led by Foster once the economy gained steam again, but now intends to keep it in place.

“We can’t even meet the demand of the number of people who want to get into the program,” Pastore said. “The despair is so real and it is very much alive ” a sense of despondency, despair — nowhere to turn.”

Josselin said she was able to turn it around just by taking the first step, and the next, and the next. She is now sharing her experience with others, and Foster suspects more will make the transition from student to tutor on what can be a long, hard road to financial stability — one people from up and down the various walks of life have traversed.

“What I try to tell people is that there is no shame or guilt about what happened in the past,” Foster said. “Just come in and start addressing it.”

Alex.Soule@scni.com; 203-964-2236; www.twitter.com/casoulman

Welcome to our April Blog Hop!

This month we are so excited to help you reach your business and life goals, featuring articles, how-to’s and resources for you today that have helped each consultant, blogger and business owner on the hop in their own lives and businesses. Get ready to be inspired for a fabulous month ahead of you as you move along through the blog hop.

You may just be starting the blog hop or may have come from 3. Kim McDaniels at iBiz Design Duchess on Natalie Bradley’s Blog Hop. If you get off track at any time, the full lineup below will help you move along from blog to blog so you make sure to see and learn from all of the articles featured here today.

Have I ever had credit card debt? Yes! There have been times in my life when I haven’t been able pay my balance in full when the bill arrives.

Credit card debt is the enemy of a good budget, but life happens. Even the best budgeter can have unplanned expenses.

According to a recent study by Trans Union, the average US adult carries $4,878 in credit card debt. That doesn’t include zero percent balances. That means the average US adult owes almost $5,000 plus the additional interest.

If this is you, I want you to take a deep breath. Debt repayment is just financial housework. There’s nothing to be afraid of here.

Do you know what’s really scary? Having company due in 5 minutes when the bathrooms aren’t clean. When that happens, do you lock the front door and pretend you’re not home? No! You walk into the bathroom and decide which part needs to be cleaned first (just in case you run out of time before the doorbell rings).

Do you know what’s really scary? Having company due in 5 minutes when the bathrooms aren’t clean. When that happens, do you lock the front door and pretend you’re not home? No! You walk into the bathroom and decide which part needs to be cleaned first (just in case you run out of time before the doorbell rings).

That’s right. I just compared paying off credit card debt to scrubbing the toilet. ![]() That’s because you want to use the same thought process with your credit cards. Some cards will need more attention than others, so you need to make a list of your debts which includes the interest rate and minimum payment amounts.

That’s because you want to use the same thought process with your credit cards. Some cards will need more attention than others, so you need to make a list of your debts which includes the interest rate and minimum payment amounts.

There are two methods to setting priorities on your credit cards.

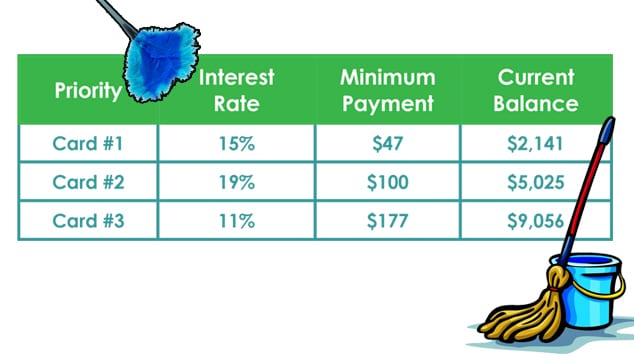

Option 1: Pay the highest interest rate first. Your list will look something like this:

This is the best option if you want to save money. Using the example above, you pay as much as your budget will allow on card #1, and only the minimum on cards #2 and #3. When #1 is paid off, you make card #2 the highest priority. Rinse and repeat until all cards are paid in full. When you pay the highest interest rate first, you pay less overall.

Option 2. Pay the smallest debt first. Your list will look something like this.

This option is good if you need to see results to stay motivated. Receiving a bill with $0 due is really satisfying. A positive emotional boost can really keep the momentum going. You can compare it to housework, dieting, or exercise. We like to see improvements.

Bottom line: You have chosen to get out of debt (your goal) and the actions that will get you there (your plan). You’ll know the best option for you and your family, and you can change tactics whenever you want as long as you’re moving forward.

Let us know which option you choose and how you are doing.

The next stop is 5. Robin Hardy at Integrity Virtual Services on Natalie Bradley’s Blog Hop! Thanks for visiting and I hope to see you again next month!

Last issue we talked about zero percent financing. Now, I want to talk about the benefits of ‘rewards cards’. You know, those credit cards that offer cash back bonuses, airline miles or other rewards that accumulate with each purchase.

Get the facts to determine if rewards cards are right for you.

Annual Fee and Interest Rates

First, rewards credit card generally have an annual fee and a higher interest rate than non-reward credit cards. You have to be absolutely certain that you will pay your balance off each and every month in full or the reward won’t be worth it.

Can You Use the Reward?

Nothing is worse than carefully accumulating points for a year, only to find you can’t use the reward. Ugh!

You need to find out what rewards are available, how many points and/or miles are needed, what are the exclusions? I was just reading an application for someone and for 25,000 points, they could get a free coach airline ticket valued at up to $400. That seems great on the surface, but what does that actually mean? Can you book that reward when and where you want to use it? How much do you have to charge to earn those 25,000 points?

If you were a part of my Nearly Free Travel Group, you know that we don’t have an airline miles rewards credit card. We earn our miles in more direct ways. We used to have several different types of rewards cards (airline miles, cruise points, etc.) but not anymore. But with everything in life, this is a choice we made. You may want to choose differently.

The Terms and Conditions

So what should you look for?

Take your time and ask questions before applying. Make a pros and cons list – does it work for your future plans and current spending habits? To start your research, go to Nerd Wallet’s Best Credit Cards of 2015 for a comparison chart that will help you determine if a rewards card could benefit you.

I keep a Gratitude Journal. Every night before bed I write down 5 things I am grateful for. Here are some financial examples from over the years:

I was able to pay more than the minimum on my credit card bill

I was able to pay more than the minimum on my credit card billAcknowledging my successes kept me motivated. It was no small effort and I needed all the help I could get.

You are on the path to paying off your debt. This is a long journey and there will be many challenges. You may want to quit before you get there. Don’t.

Congratulate yourself for taking the first steps. Celebrate all the good work you are doing and will do. Remember to celebrate with something that isn’t going to give you more debt. For example, we love to treat ourselves with summer picnics in the park where they show free movies or concerts.

We want to hear from you! Tell us how it’s going. What you share may inspire others to keep going.