Here’s how

Time to spring clean your finances

Finances need a clean up, why not do this now for spring

One woman’s journey with clutter and downsizing

We’re cleaning out our home too.

Summer rental scams

Don’t let this happen to you

http://abc7ny.com/news/7-on-your-side-how-to-foil-summer-rental-fraud-before-it-happens/1900916/

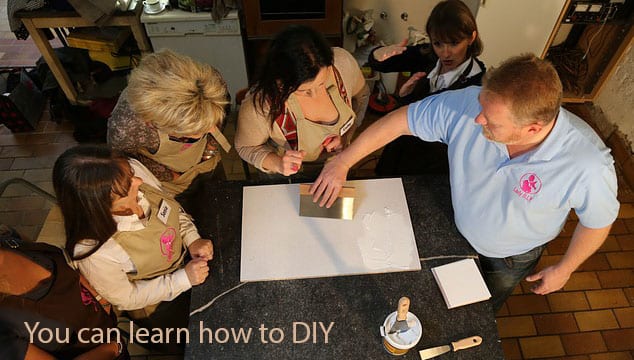

Your DIY Projects

It’s spring and with that we think about projects for our home each. What needs to be done for maintenance? What to we want / need to upgrade / replace? How much can we do ourselves vs. hiring out? How about doing home projects or repairs yourself.

Do you have a broken tile that needs replacing? Do you want to refinish a piece of furniture? Do you want to repair a small leak? Do you want to create a patio? Before you jump into a DIY project, take a few hours to learn a little more about your project.

It’s easier than ever today to learn how to DIY. Home improvement stores offer free classes and/or you can watch a how-to video on the internet. It’s possible to learn from the pros, or from experienced tinkerers, just by setting aside a Saturday morning.

We renovated our current home and were able to do some of it ourselves. We did the demolition: ripped up carpets and vinyl flooring; removed kitchen and bath cabinets; and broke down the plaster walls. We also did as much of the work ourselves as we thought we could handle: we rolled out and stapled the insulation; and taped and painted the inside of the house.

That may be more than you want to tackle, but our partial DIY brought our home improvement project within our budget, so we could afford professional contractors to remove a load bearing wall, install a header beam, rewire the electricity, and add a bath.

Are you ready to tackle a home project or repair? The questions you should be asking yourself are:

- Do you have the time and energy needed to complete the project?

- Do you know how, or could you learn the skills needed, to complete the project?

- Can you afford to have the work completely hired out?

Let me know what you decided, and good luck on your project! Tell me how it turned out in the comments.

What’s More Important-Less Debt or an Emergency Fund?

The age-old question of payoff debt versus an emergency fund – which is more important?

If you have debt, then you know that the interest you are paying is a drain on your finances. You are correct, that interest is a waste of your hard-earned money. You know that you need an emergency fund and you have been meaning to start one, but you just don’t have the money.

Which should you tackle first? Let’s assume you have $500 in your budget to work with and we will look at a couple of scenarios.

#1 – You have debt totaling $10,000 and you are paying the minimum payment of $250 per month at an interest rate of 20%. It will take you 67 months (5+ years) and you will have paid back $16,750 ($6,750 in interest). That’s assuming you don’t take on more debt.

Then you put the remaining $250 to start your emergency fund.

#2 – You increase your payment on your debt to $500 per month. It will take you 25 months (just over 2 years) and you will have paid back $12,500.

You will not be starting your emergency fund until after the debt is paid. What would you do if an emergency expense happened? How would you pay for it?

As you can see, the answer is somewhere in the middle and you can think outside the box for faster results. You could look into reducing the interest rate on your debt – refinancing, balance transfer for a lower interest rate etc. The quicker you payoff the balance, the less you will pay in interest.

You need an emergency fund to be prepared for whatever happens in life. You will want to start to save something on a regular basis each and every month, even if you have debt.

Save

Friendship and Money

Friendship and money – these are things we treasure, but sometimes they can be at odds. I can remember when I started my first business and money was tight. I had friends that wanted us to do what we had always done in the past – going to dinner, going to a sporting event / concerts and more – just like old times.

I remember thinking, I can’t afford this right now. Don’t they realize I just started a business and I am not making the money I used to? How could they even ask this of us to do this? All these thoughts went through my head, but I was too embarrassed to say them out loud.

One of the things I look back on and wish that I was able to share my thoughts. But I didn’t share my thoughts. I kept up outside appearances and did whatever with my friends anyway. I didn’t want to disappoint our friends. I didn’t want them to think that we didn’t have the money. In reality, we didn’t have the money then and we were keeping up outside appearances to “keep up with the Jones” instead of being true to ourselves.

This was and is a hard lesson to learn. We all want to have everything and marketing makes us believe we need all of this. Do we? I think this comes with age and wisdom and I wish I had learned this earlier in life, but I know this now. I know that I treasure time with friends and quiet time and not necessary the stuff.

I personally have grown over time from this young woman and now am more able to express my feeling / situation to others. I can turn down invites, that I don’t want to do. I can say, that’s not something I really want to spend money on. I can request separate checks versus splitting the bill 50/50. All of these are choices that you get to make because it’s your money and time.

Don’t be afraid to express your thoughts out loud to your friends. Be gracious in your words no matter which side you are on. Friendship and money are always going to be a part of your life. Be comfortable with your friends and money and be willing to share your feelings with others. Maybe they are feeling the same and can’t express it.

Save

Save

Save

Save

Budgeting

This newsletter, we are going to talk about spending too much! Personally, we upgraded the master bedroom and bath. In addition to the insurance deductible, we added on the additional expense of better bathroom fixtures – granite counter, higher end faucet, natural stone ceramic tile and more. Yes, we did spend more (maybe too much). With a new year beginning, we need to reign in our expenses and rebuild our savings.

If your 2017 goal is to track your expenses and come up with your actual budget, there is an exercise I like my clients to do when they have their budget created. Take out two different color highlighters. Use one color for your fixed expenses (amounts that can’t easily change) and then use the second color for expenses that you can adjust or eliminate. Typically, I see three areas for the adjust or eliminate category:

- Penalty fees (late fees, overdraft, over limit, etc.)

- Do it yourself fees – these are things that you pay others to do that you could do yourself and save money (lawn maintenance, snow removal, housecleaning, coffee, manicure / pedicure, laundry, trash pick-up, etc.)

- Life extras – these are the things that you do that you could reduce or live without (entertainment, movies, concerts, dinning out / take-out food, personal care, etc.)

Now make a list of five ways to reduce or eliminate specific items. For example, I could find a teen to shovel my snow versus paying a snow plowing service.I could download a movie for free (Hoopla) or borrow from the library versus renting and not returning on time and incurring a late fee. I could balance my checkbook regularly to know how much money I have available and not incur an overdraft fee. These are just a couple of ideas. Now make your list and track your savings. How much did you save this month? How much would that be in one year?

Are you getting the hang of it? Are there more ways to reduce or save on your expenses? Share what expenses you have reduced or eliminated by 5pm EST on March 10, 2017 as a comment below and you could win a copy of my new book 111 Ways To Save. Three winners will be selected randomly at the end of March.

Save

Save

Save

Save

What Does Your Cruise Include?

Are you thinking about cruising and not sure if it’s for you or not? Here are some tips on what to do and what not to do and how to save tons of money on your vacation.

A cruise can be like an all-inclusive vacation, but not exactly. While most of the cruise is included, not everything is included in the price.

|

Included |

Not Included |

|

Accommodations – room, housekeeping, TV, some in room movies |

Mini Bar / Pay Movies |

|

Most food – Dining room, Buffet, Pizza, Ice Cream |

Specialty Dining Restaurants, Specialty Ice Cream |

|

Beverages – Non-Carbonated Drinks, Coffee / Tea, Juice, Water |

Soda, Alcohol, Specialty Coffee, Bottled Water |

|

Entertainment – Movies, Miniature Golf, Ice Skating, Ping Pong, Swimming, Water Park, Rock Climbing, Ice Skating, Rollerblading, Games, Live Shows, Comedy Venues, Live Music and More |

Shore Excursions – when off the ship with the cruise line on an activity, tour, etc. Casino, Video Arcade, Golf Simulator, On-Board Shopping |

|

Fitness, Gym, Some Fitness Classes, Jogging / Walking Track, Pools, Hot Tubs |

Some Exercise Classes, Personal Training |

|

|

Personal Care – Salon, Massage etc. |

|

|

Internet, Ship to Shore Phone Calls, Your cell phone |

|

Gratuities to restaurant staff and cabin steward (although this is a separate charge when booking) |

Additional Gratuities, Tips for crew members |

|

|

Dry Cleaning / Laundry (some ships have washers and driers available) |

|

Motion Sickness / Norovirus Treatments |

Medical / Doctors Services |

So how do you avoid or minimize your costs?

There is so much food available either in the dining room and/or buffet most hours of the day (and night), there is no reason that we find we need to pay for additional foods. Hungry at 11 pm – go to the 24 hour pizza and salad area. Don’t want to leave your stateroom – order food from room service (it’s free, between 5 am and midnight). Still hungry check out the midnight snacks.

Plan ahead for what to do on shore – we do lots of things for free or low cost and do not go through the cruise line. Do your research and see what options are available. We took a great free walking tour of Valencia, Spain. All it cost us was a tip for the guide. You have to be aware of the time. When you are on your own, you could miss the ship sailing if you don’t pay attention to the time. One note, make sure if you book something on your own and the ships misses the port (weather related), that you will get a refund.

Some cruise lines will let you bring limited quantities of non-alcoholic beverages on board. Check with your cruise line before you cruise. We have flown to the cruise and stopped at the store to pick up bottled water and soda on the way to the pier. If they don’t, you can send yourself a gift (bottled water is less expensive to give yourself a case vs. buying as you go at the bar).

Alcohol is a big money maker for the cruise line. You need to determine how much you intend to drink. Check out the packages to save money. If you don’t purchase the package, here are few tips – if you don’t intend to take home the souvenir glass – don’t purchase a drink in this glass. Look for events with free alcohol – champagne art auctions, captain’s receptions, past guest parties and more offer limited free drinks.

Cell phone and internet service – it can be expensive on board. We have always found free internet in port when we wanted to check in. Otherwise, purchase in advance for discounts. I did this when I was taking an online college class and needed to post daily to the discussion.

The above is based on our experience on Carnival and Royal Caribbean, other cruise lines can have different policies and costs. Do your research ahead of time, so that you can understand the costs before you incur the charge. This is not a surprise you want to incur as your vacation winds down. Happy Travels!

Save

Save

Save

Save

Holiday Tipping

The holidays are coming! The holidays are coming! You probably know this and the retail stores are starting the holidays off during the summer. From Labor Day weekend, I see the holidays all over the place in retail stores. I’m thinking the beach and heat and they are thinking December. While it’s not bad to plan ahead and be proactive, it’s too early for me, but it’s never too early to think about your budget.

Tipping is always something that comes up around this time of year. Here are my thoughts and what we do.

First, we don’t wait for the holidays. In my opinion, good service doesn’t have to wait until the end of the year. If someone goes out of their way or does an exceptional job, then by all means tip them. A while back we bought dining room chairs and the person in the store took the time to go out of his way. That deserved a tip then and there.

Second, give what you can afford. While it’s nice to give cash and to be able to give to everyone, that may not work for your budget. You can thank people verbally and express your gratitude with a conversation, special note in a card, contact the company or supervisor and express the great service you received, instead of cash. I have made calls to the airline to express how grateful we were for a particular person and the excellent service we received. Rarely do companies get calls like this and they can seem shocked at the call.

This is my plan of attack. Create a list people in your life and here are some examples:

Mail Carrier / Package Delivery

Personal Care (Hair, Nails, Massage)

Child & Elder Care

Teachers

House Cleaner / Lawn Care / Snow Removal Care

Pet People (Groomers, Walkers etc.)

Doorman / Maintenance Workers

Assistants / Key Employees

Then make a plan. If you were to tip everyone in one week, you would break the bank. I like to start after Thanksgiving and end this by New Year. Now if you have decided on an actual tip, it can take the format of the cash or possibly a cash gift card, unless you know them well enough to pick a specific merchant’s general gift card. Spreading out the tipping, helps my budget. Plus, I like to do this in person. So when I have a service done, that’s the time I tip, and again throughout the year helps my budget as well.

Finally for cash tips, make a trip to the bank and get nice new crisp bills and have thank you or blank note cards. People who get many tips need to know who they received it from, so a short thoughtful note handwritten in the card works well. It always is so much nicer to give a tip with a good presentation. I feel that the recipient thinks you took the time to think about them versus handing them crumpled bills from your wallet.

Not sure how much to give? That’s entirely up to you. There are many guides on the internet to assist you, but ultimately it’s your choice. Make your plan now so that you check one thing off your holiday to do list.

Save

- « Previous Page

- 1

- …

- 12

- 13

- 14

- 15

- 16

- …

- 25

- Next Page »