Here’s part 2 about your credit score

https://www.dailyworth.com/posts/4405-the-total-amount-of-credit-scores-you-have-part-2

Tips for Successful Personal Finances

Here’s part 2 about your credit score

https://www.dailyworth.com/posts/4405-the-total-amount-of-credit-scores-you-have-part-2

This might explain how many scores and why they are different

https://www.dailyworth.com/posts/4404-the-total-amount-of-credit-scores-you-have

Yes, we all probably want this and therein lies the problem. How do we attain this?

There are some generally agreed upon principles that are good practices that we all should attain to:

These are all great suggestions and work really well, but what if you need to work on some of these steps. In my opinion it all goes back to budgeting. Budgeting is the road map of your finances. You can see where your money is going and then make the necessary steps to eliminate consumer debt, reduce your spending, save by paying yourself first and break your habit of keeping up with the Jones’. It may sound simple but it isn’t. So with this issue and the next three I will tackle these issues.

Today, let’s look at avoiding consumer debt. This can be difficult to attain. But on the other hand, this is so important – too important not to strive for.

There have been times in my life that I have had more debt than I would like to admit. Yes, this happens to me too. In my opinion, there are two steps to start on the path to being debt free. First, you have to stop creating debt. Yes, you heard me. You need to do whatever it takes to avoid adding more to the debt. With that said, you can’t put every extra penny towards your debt and not have an emergency fund. Otherwise, the next time an emergency happens and you don’t have a fund to fall back on, you will create more debt.

In May and June, my husband had surgery and was home from work for a month without pay. We only had about 6 weeks’ notice to plan for this. We got through this period with the help of the emergency fund and savings to cover the shortfall. This was the key to us being able to live and pay the bills. Without the savings to fall back on, we would have had to use credit cards and create debt. So you can see how having an emergency savings plays a big part in getting rid of debt.

Back to the debt. Second, there are many ways to tackle this. Start by taking an honest look at your all your debt. Make a list including how much you owe, the minimum payment, interest rate, etc. I understand this is hard, but it’s necessary.

Now make the plan. You can payoff the smallest debt first to eliminate one debt (gives you momentum). You can payoff the debt with the highest interest rate (saves you money). You can plan to get more money (bringing in more income) with many options to add to your payment. Take some time to brainstorm what will work best for you and then put that plan into action.

You’ll need to stop creating additional debt and to create or increase your emergency fund. Next issue, I will discuss spending less than you earn/pay yourself first.

Save

Save

Save

Save

We all want to save for retirement, but there never seems to be enough money left over to save. Does this sound familiar?

The first rule of saving for retirement is, if you are offered free money take it. If your employer sponsored retirement plan offers you matching funds, take it. Contributing to a retirement plan through your paycheck is a great way to get started on the path of regular automatic saving. The earlier you start this habit the better off you will become. On the other side if you haven’t done this, it’s never too late to start now. In this case, free money is a good thing

Next you want to manage your debt. Debt is the enemy to your budget, so you want to avoid it at all cost. I am not saying don’t borrow or use credit, what I am saying is to use it wisely. Don’t become a slave to your debt and that you live paycheck to paycheck trying to keep up with your debt payments.

Charge wisely and only amounts that you can pay off easily. If you find yourself with an emergency and you have to borrow money, evaluate your options and make the choice that is best for you and your budget. Pay back the debt as quickly as possible to avoid as much of the finance / interest charges as possible.

Lastly, gratification – are you someone who needs instant gratification? Do you buy without a payback plan? Look at the food cost (groceries, dining out, take out etc.), shopping, memberships, entertainment etc. These are the expenses, that where the instant gratification that can harm your budget. These are the first defense against the leaks in your budget. Plug those holes to have more money for your retirement.

Think about your finances then make a plan to implement these strategies one by one. Once you master one, start the next. Remember that your finances will not change overnight, be patient and remember it takes time.

Hello, it’s Jill again, reminding you to get your New Year started off right.

How to Order Your Credit Report

The only authorized source for your report is AnnualCreditReport.com. You won’t be charged and they won’t force you to sign up for “credit monitoring”. It’s yours to review by law. Learn more.

Not comfortable ordering online? There are other ways to order your report:

What should you do with your report?

Were you hoping for your credit score instead?

Try CreditKarma.com. It doesn’t give you a FICO score, but it comes close by providing scores from TransUnion and VantageScore. And, there’s no charge for you. CreditKarma funds their service through website advertising.

It’s so nice to start the year with a clean slate!

![]()

P.S. I’ll send you another reminder in May so you can enjoy your summer.

Hello, it’s Jill again, reminding you to get your finances in order so you can enjoy the holiday season.

How to Order Your Credit Report

The only authorized source for your report is AnnualCreditReport.com. You won’t be charged and they won’t force you to sign up for “credit monitoring”. It’s yours to review by law. Learn more.

Visit www.AnnualCreditReport.com:

Not comfortable ordering online? There are other ways to order your report:

What should you do with your report?

Were you hoping for your credit score instead? Try CreditKarma.com. It doesn’t give you a FICO score, but it comes close by providing scores from TransUnion and VantageScore. And, there’s no charge for you. CreditKarma funds their service through website advertising.

May you have a fun and meaningful holiday season from Halloween through to New Year’s Eve and everything in between.

![]()

P.S. I’ll send you another reminder in January so you can start 2016 off right.

Welcome to our April Blog Hop!

This month we are so excited to help you reach your business and life goals, featuring articles, how-to’s and resources for you today that have helped each consultant, blogger and business owner on the hop in their own lives and businesses. Get ready to be inspired for a fabulous month ahead of you as you move along through the blog hop.

You may just be starting the blog hop or may have come from 3. Kim McDaniels at iBiz Design Duchess on Natalie Bradley’s Blog Hop. If you get off track at any time, the full lineup below will help you move along from blog to blog so you make sure to see and learn from all of the articles featured here today.

Have I ever had credit card debt? Yes! There have been times in my life when I haven’t been able pay my balance in full when the bill arrives.

Credit card debt is the enemy of a good budget, but life happens. Even the best budgeter can have unplanned expenses.

According to a recent study by Trans Union, the average US adult carries $4,878 in credit card debt. That doesn’t include zero percent balances. That means the average US adult owes almost $5,000 plus the additional interest.

If this is you, I want you to take a deep breath. Debt repayment is just financial housework. There’s nothing to be afraid of here.

Do you know what’s really scary? Having company due in 5 minutes when the bathrooms aren’t clean. When that happens, do you lock the front door and pretend you’re not home? No! You walk into the bathroom and decide which part needs to be cleaned first (just in case you run out of time before the doorbell rings).

Do you know what’s really scary? Having company due in 5 minutes when the bathrooms aren’t clean. When that happens, do you lock the front door and pretend you’re not home? No! You walk into the bathroom and decide which part needs to be cleaned first (just in case you run out of time before the doorbell rings).

That’s right. I just compared paying off credit card debt to scrubbing the toilet. ![]() That’s because you want to use the same thought process with your credit cards. Some cards will need more attention than others, so you need to make a list of your debts which includes the interest rate and minimum payment amounts.

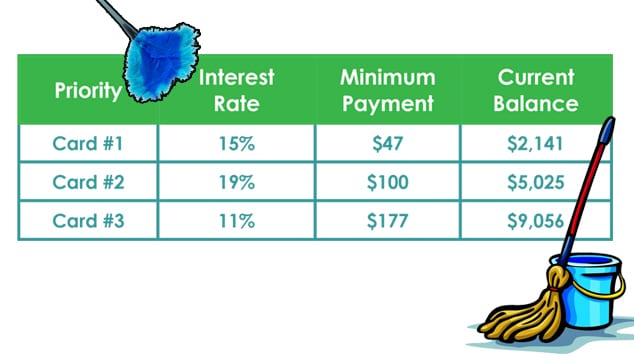

That’s because you want to use the same thought process with your credit cards. Some cards will need more attention than others, so you need to make a list of your debts which includes the interest rate and minimum payment amounts.

There are two methods to setting priorities on your credit cards.

Option 1: Pay the highest interest rate first. Your list will look something like this:

This is the best option if you want to save money. Using the example above, you pay as much as your budget will allow on card #1, and only the minimum on cards #2 and #3. When #1 is paid off, you make card #2 the highest priority. Rinse and repeat until all cards are paid in full. When you pay the highest interest rate first, you pay less overall.

Option 2. Pay the smallest debt first. Your list will look something like this.

This option is good if you need to see results to stay motivated. Receiving a bill with $0 due is really satisfying. A positive emotional boost can really keep the momentum going. You can compare it to housework, dieting, or exercise. We like to see improvements.

Bottom line: You have chosen to get out of debt (your goal) and the actions that will get you there (your plan). You’ll know the best option for you and your family, and you can change tactics whenever you want as long as you’re moving forward.

Let us know which option you choose and how you are doing.

The next stop is 5. Robin Hardy at Integrity Virtual Services on Natalie Bradley’s Blog Hop! Thanks for visiting and I hope to see you again next month!

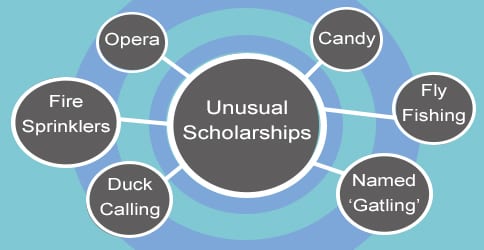

Let’s talk about paying for tuition. Last issue we discussed financial aid – specifically, the importance of submitting your FAFSA application as soon as possible. While it’s nice to get financial aid, many students don’t qualify. I am one of them. So what can you do?

Apply for a Scholarhip

Many scholarships require a FAFSA application, so get moving on it.

What scholarships should you apply for? Look for ones that meet your skills, interests or living status. For example:

Read over the requirements carefully to make sure you meet them. Don’t waste your time, or theirs, by applying for a scholarship you won’t get because you aren’t Polish American or haven’t studied dance.

Be prepared to write essays, get references and provide any proofs required. This will take time and effort, but if you receive a scholarship – Yay! You got free money!

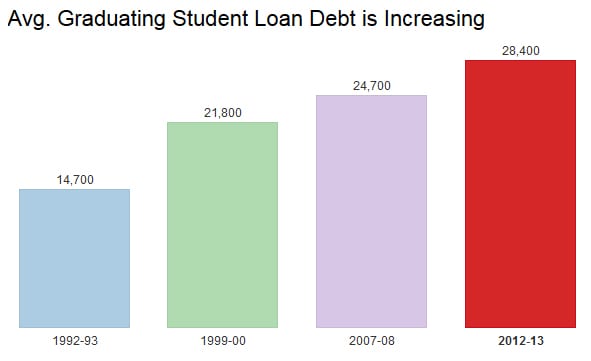

Student Loans – The Last Resort

According to US News and World Report, 69% of graduating students in 2013 had an average of $28,400 in student loan debt. Depending on the college (state or private), the actual range was between $2,500 and $71,000. This is a huge amount of debt to start your career with.

How to choose a loan:

Understand your student loans before you sign to protect your future financial well-being.