Learn how to travel for Nearly Free!

-> Sign up here for the full free package including handouts

-> Sign up here if you want to go directly to the Facebook group.

Learn more at jillrussofoster.com/nearlyfreetravel

Tips for Successful Personal Finances

Learn how to travel for Nearly Free!

-> Sign up here for the full free package including handouts

-> Sign up here if you want to go directly to the Facebook group.

Learn more at jillrussofoster.com/nearlyfreetravel

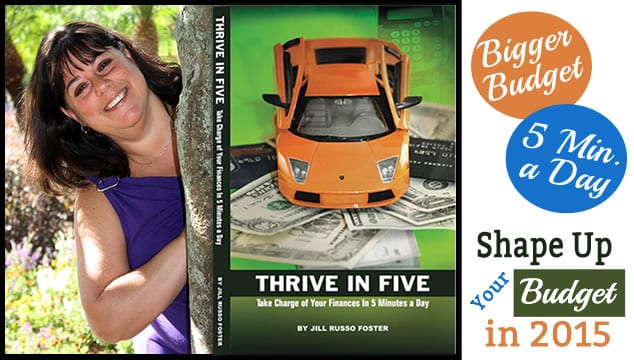

Through December 15, get Thrive in Five at a Special Rate.

Jill will start shipping on December 1st, so order now in time for the holidays.

Each year do you resolve to improve your finances only to have something happen that pushes you back to the same place you were last year? Thrive In Five: Take Charge of Your Finances in 5 Minutes a Day will help you change that. With daily short tips that take five minutes or less, this book will help you improve your credit score, spend less, and save more money – all while getting organized!

Learn more:

“Thrive In Five: Take Charge of Your Finances In Five Minutes A Day” is a comprehensive, no nonsense book.

Jill’s direct, easy-to-understand style makes it Super Easy to take control of your finances TODAY. As someone who’s worked in a financial institution for 15 years, I’ve never seen everything so comprehensively laid out. This book should be required reading, and can be given to anyone at any age to help them save money. Jill truly understands that finances don’t have to be dull, boring and complicated. She even gives you days to ‘catch up’!

It sends chills up my spine to think about all of the people who don’t know these simple, doable steps.

READ this book and quickly take control of your finances. And get this— Each day the steps are written in a day-by-day, paint-by-numbers format, all EASY yet DOABLE!

Hey, it only takes five minutes or so each day — yet each step can take you one step closer to finally taking control of your finances!

I say get this book and get this book right NOW! It’s awesome!”

– Tracey Fieber, Retirement Transition Expert

New Face of Retirement

www.NewFaceofRetirement.com

“In the changing credit market, your advice has been in valuable. I have learned what factors make up a credit score and how I can help my clients to improve and avoid hurting their scores.”

Rick Bangs, CPA, Richard E. Bangs, Jr CPA

“Jill is always up-to-date on the latest financial trends and has a stellar way of breaking it down so it’s easy to understand. Over the past three years I have followed her newsletter, I have learned how to better and easily manage my finances including budgeting and monitoring my credit report.”

ChaChanna Simpson, Owner, Twentity.com

“I have known Jill Russo Foster for several years and her knowledge of personal finances spans many areas such as credit, financing, debt reduction, budgeting and more. She can explain topics in an easy to understand manner so that you know what to do for your situation. Jill has real passion and concern for all she speaks to. She wants people to live better lives by gaining control of their finances.”

Marian Cicolello, WBDC, CTWBDC.org

“I have had the pleasure of working with, listening to, and relying on Jill Russo Foster and her deep knowledge of personal finance and credit for the past year. Jill’s wealth of experience and “easy to follow” advice is as important to young adults as are the basic educational requirements of Math, English, and Science.

I wholeheartedly recommend Jill’s books, seminars, and forums to anyone interested in clean credit, low finance charges, and a bright fiscal future.”

State Representative Fred Camillo, 151st District-CT, RepFredCamillo.com

“Jill Russo Foster’s book has had a profound effect on how we view our money situation and how we teach our children about finances. I would recommend her books and services to anyone who is serious about saving and responsibly spending their money.”

Michael LaMagna, Esq.

“This year, far more than any other year, my husband Paul (the neat freak) and I (not so much) have both felt the need to “clean house”. In past years we haven’t been so aligned on this issue! Thanks to charitable organizations that will come right to your door and pick up unwanted clothing, home furnishings, and assorted tchotchkes and then put them to very good use, it’s easier than ever. We’ve both been feeling weighted down by the unnecessary clutter, and each time we schedule a pickup, it makes us more aware of the things that are not needed, and more eager to schedule another pickup – and more conscious about buying things that aren’t truly needed. We’ve also cut back on buying material gifts for the kids and opting for “experience” gifts such as skiing lessons, tickets to a show, and family outings. Truly, they don’t miss the gifts at all – the average toy captures their attention for literally about a week.”

Carolyn Aversano, Publisher / Managing Editor, Natural Awakenings Magazine, Fairfield County, ENaturalAwakenings.com

“Thanks to Jill Russo Foster, I balance my checkbook every day. It may sound time-consuming, but it’s the easiest thing I’ve ever done. My husband and I used to overdraw our account because we both use debit cards. Monthly balancing took forever, because we had a hundred tiny transactions and receipts. Jill recommended daily balancing, and that worked for us. I log into our bank account in the morning, balance our transactions, and it only takes a few minutes a day. Thanks, Jill!”

Valerie Crowley, Virtual Assistant, ValerieCrowley.com

“In today’s hectic world, it’s hard to keep everything in check. Working & raising a family can leave little time for much else. But, our finances are one thing we simply can’t let slide. Using her years of experience in the financial world, Jill has made it simple to take charge of your finances, by creating bite-sized pieces that anyone can follow. With something as critical as your finances, you can’t afford not to carve out 5 minutes each day to get yourself in gear!”

Kristin Andree, President – Andree Media & Consulting,

Author: Don’t Make Me Pull This Car Over: A Roadmap for the Working Mom

“Ready to quit worrying and start taking control of your finances? Get a copy of Jill’s book (or book title) and get started today!

Jill steps you through different priorities each month, one task a day. Rather than feeling overwhelmed, you’ll be amazed at how easy it is to take the things that you have been putting off and finally getting them done!”

Vicki Heise, Founder, Live Your Healthy Life, LiveYourHealthyLife.com

“Finances are a big part of everyday life and can be costly. My client, Jill Russo Foster, breaks down finances into easy to understand steps that will help you get a grasp of your finances.”

Steve Harrison, Bradley Communications, www.FreePublicity.com

Hello, it’s Jill again, reminding you to get your finances in order for stress-free holiday celebrations.

How to Order Your Credit Report

Order your credit report from www.AnnualCreditReport.com – the ONLY authorized source your no-cost annual credit report that’s yours by law. Learn more.

When ordering online – visit www.AnnualCreditReport.com:

Not comfortable ordering online? There are other ways to order your report:

It doesn’t matter how you get your report, the most important thing is that you do! Then…

Were you hoping to get your credit score instead? Try CreditKarma.com. CreditKarma does not supply a FICO score, but it does provide scores from TransUnion and VantageScore. And, there’s no charge for you. CreditKarma funds their service through website advertising.

May you have a lovely holiday season from Halloween through to New Year’s Eve and everything in between.

![]()

P.S. I’ll send you another reminder in January so you can start 2015 off right.

You should check your credit report three times a year to check for accuracy and identity theft. (Go through www.AnnualCreditReport.com) As a reader of my newsletter, you get reminder emails with instructions so you can protect your credit and financial information.

You should check your credit report three times a year to check for accuracy and identity theft. (Go through www.AnnualCreditReport.com) As a reader of my newsletter, you get reminder emails with instructions so you can protect your credit and financial information.

If you’re not worried, here are some identity theft statistics from www.StatisticBrain.com that will help set the mood.

| Identity Theft / Fraud Statistics | Data |

| Average number of U.S. identity fraud victims annually | 11,571,900 |

| Percent of U.S. households that reported some type of identity fraud | 7 % |

| Average financial loss per identity theft incident | $4,930 |

| Total financial loss attributed to identity theft in 2013 | $21 billion |

.

| Percent of Reported Identity Thefts by Type of Fraud | Percent Reported |

| Misuse of Existing Credit Card | 64.1 % |

| Misuse of Other Existing Bank Account | 35 % |

| Misuse of Personal Information | 14.2 % |

There are free or low cost reports in addition to your credit report that will help you prevent, and discover, identity theft. These are compiled by lesser known consumer reporting agencies and were created for specific industries. Just because they weren’t created to benefit you, doesn’t mean you can’t use them.

For example, when you open a bank account with a new bank, they want to see your check writing history. Or, when you want to switch insurance companies, they want to see what claims you have filed. You can view those same reports to see if anyone has written checks or requested claims in your name. You can get a statement from your health insurance company once a year to compare to your information to what is on file. That means you may be able to catch medical identity theft early. Otherwise you wouldn’t know who is using your identity for medical theft until your insurance company declines a claim because they previously paid for it. You can do the same for prescriptions too.

For example, when you open a bank account with a new bank, they want to see your check writing history. Or, when you want to switch insurance companies, they want to see what claims you have filed. You can view those same reports to see if anyone has written checks or requested claims in your name. You can get a statement from your health insurance company once a year to compare to your information to what is on file. That means you may be able to catch medical identity theft early. Otherwise you wouldn’t know who is using your identity for medical theft until your insurance company declines a claim because they previously paid for it. You can do the same for prescriptions too.

The Fair Credit Reporting Act makes these reports available to you annually for a fee (some are free). To get a complete list of consumer reporting agencies and how to get your reports, go to ConsumerFinance.gov

There, you’ll find all kinds of reports, including check writing history, public records (criminal history, property ownership, liens, and bankruptcy), healthcare information, insurance claims, rental history, employment, etc.

It may sound like a lot of effort, but something may happen that makes you wonder. Did you lose your wallet? Did your roommate get arrested for theft? Did you recently get turned down for a loan when you thought your credit was good? Taking preventative steps is much easier than cleaning up after your identity is stolen.

Take some time and go through all the reports available to you and start with one at a time in the order that makes sense for you and your family.

As the weather turns to Spring, homeowner’s start to think about home improvements. Several years back, we did a major home improvement to our home and we had to make some tough decisions about what improvements to make. Do we make changes that will make our lives easier? Do we do something that would bring added value to the home? These are the tough decisions we had to make as homeowners.

As the weather turns to Spring, homeowner’s start to think about home improvements. Several years back, we did a major home improvement to our home and we had to make some tough decisions about what improvements to make. Do we make changes that will make our lives easier? Do we do something that would bring added value to the home? These are the tough decisions we had to make as homeowners.

First, do the improvements that will ward off problems. For example, it’s better to replace a roof than to wait until it leaks. Once it leaks, you have to repair interior water damage on top of replacing the roof. In my opinion, regular maintenance and preventative maintenance are your top priority.

But what about the other things you want to do around your home. According to Remodeling Magazine, here is a chart about average cost and what portion of that cost can you expect to recoup in value.

|

Project |

Job Cost |

Resale |

Portion |

| Entry door replacement (steel) |

$1,162 |

$1,122 |

96.60% |

| Minor kitchen remodel |

$18,856 |

$15,585 |

82.70% |

| Window replacement (wood) |

$10,926 |

$8,662 |

79.30% |

| Basement remodel |

$62,834 |

$48,777 |

77.60% |

| Major kitchen remodel |

$54,909 |

$40,732 |

74.20% |

| Bathroom remodel |

$16,128 |

$11,688 |

72.50% |

| Roofing replacement |

$18,913 |

$12,777 |

67.60% |

| Backup power generator |

$11,742 |

$7,922 |

67.50% |

| Home office remodel |

$28,000 |

$13,697 |

48.90% |

SOURCE: Remodeling Magazine 2014 Cost vs. Value Report, mid-range projects

So, what if the improvement you want, isn’t just something that will make the house look or feel nicer. I personally don’t think the choice is as easy as picking the project most likely to recoup your expenses. The first question you need to ask yourself is, “How long to do I expect to live here?”

If you are planning to sell in the near future, then recouping your expenses is a major factor in your choice. Talk with a realtor and discuss what improvements will increase your home’s value and recoup your money.

If you are planning to sell in the near future, then recouping your expenses is a major factor in your choice. Talk with a realtor and discuss what improvements will increase your home’s value and recoup your money.

But what if you are planning to live in the home for a long time? Then choose the project that will make your life more enjoyable. If you are handy and have the time, you can do some improvements yourself. A fresh coat of paint always makes a home look better and most people can do this themselves. If you want to tackle a bigger project yourself, then your home improvement store can be a big help with how-to classes.

In case you were wondering, we did some major improvements – renovated the kitchen, remodeled a bath, added an additional bath, updated the electrical, etc. We worked within a set dollar budget and did a lot of the work ourselves. Bottom line, think about what you want to do, and do your research first. Your kitchen remodel may be affordable if you reface the cabinets instead of replacing them. It’s something to think about.

This was a big project to give you to do in five minutes a day for seven days. I am giving you two additional days to wrap up this snapshot of where you stand.

Share this post for the Financial Literacy Month Contest. Learn more at www.JillRussoFoster.com/financial-literacy-month-2013