Welcome to our April Blog Hop!

This month we are so excited to help you reach your business and life goals, featuring articles, how-to’s and resources for you today that have helped each consultant, blogger and business owner on the hop in their own lives and businesses. Get ready to be inspired for a fabulous month ahead of you as you move along through the blog hop.

You may just be starting the blog hop or may have come from 3. Kim McDaniels at iBiz Design Duchess on Natalie Bradley’s Blog Hop. If you get off track at any time, the full lineup below will help you move along from blog to blog so you make sure to see and learn from all of the articles featured here today.

Financial Spring Cleaning: What should you do first?

Have I ever had credit card debt? Yes! There have been times in my life when I haven’t been able pay my balance in full when the bill arrives.

Credit card debt is the enemy of a good budget, but life happens. Even the best budgeter can have unplanned expenses.

According to a recent study by Trans Union, the average US adult carries $4,878 in credit card debt. That doesn’t include zero percent balances. That means the average US adult owes almost $5,000 plus the additional interest.

If this is you, I want you to take a deep breath. Debt repayment is just financial housework. There’s nothing to be afraid of here.

Do you know what’s really scary? Having company due in 5 minutes when the bathrooms aren’t clean. When that happens, do you lock the front door and pretend you’re not home? No! You walk into the bathroom and decide which part needs to be cleaned first (just in case you run out of time before the doorbell rings).

Do you know what’s really scary? Having company due in 5 minutes when the bathrooms aren’t clean. When that happens, do you lock the front door and pretend you’re not home? No! You walk into the bathroom and decide which part needs to be cleaned first (just in case you run out of time before the doorbell rings).

That’s right. I just compared paying off credit card debt to scrubbing the toilet. ![]() That’s because you want to use the same thought process with your credit cards. Some cards will need more attention than others, so you need to make a list of your debts which includes the interest rate and minimum payment amounts.

That’s because you want to use the same thought process with your credit cards. Some cards will need more attention than others, so you need to make a list of your debts which includes the interest rate and minimum payment amounts.

There are two methods to setting priorities on your credit cards.

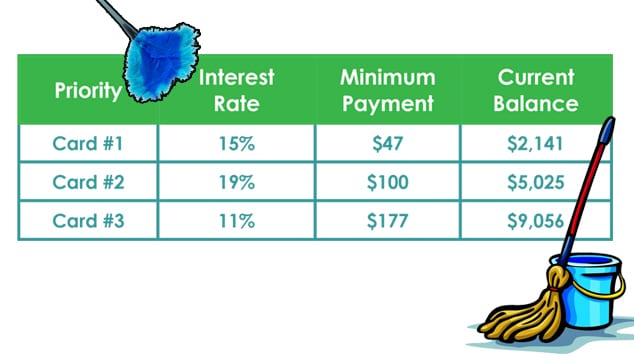

Option 1: Pay the highest interest rate first. Your list will look something like this:

This is the best option if you want to save money. Using the example above, you pay as much as your budget will allow on card #1, and only the minimum on cards #2 and #3. When #1 is paid off, you make card #2 the highest priority. Rinse and repeat until all cards are paid in full. When you pay the highest interest rate first, you pay less overall.

Option 2. Pay the smallest debt first. Your list will look something like this.

This option is good if you need to see results to stay motivated. Receiving a bill with $0 due is really satisfying. A positive emotional boost can really keep the momentum going. You can compare it to housework, dieting, or exercise. We like to see improvements.

Bottom line: You have chosen to get out of debt (your goal) and the actions that will get you there (your plan). You’ll know the best option for you and your family, and you can change tactics whenever you want as long as you’re moving forward.

Let us know which option you choose and how you are doing.

The next stop is 5. Robin Hardy at Integrity Virtual Services on Natalie Bradley’s Blog Hop! Thanks for visiting and I hope to see you again next month!

Blog Hop participants lineup:

- Natalie Bradley at Natalie Bradley Consulting

- Deb Brown at Touch Your Client’s Heart

- Kim McDaniels at iBiz Design Duchess

- Jill Russo at JillRussoFoster.com <<– you are here!

- Robin Hardy at Integrity Virtual Services

Leave a Reply